Tags

My wifeTrish, with George Clooney in Bellagio, 2014

If someone’s had a brush with fame, they tend to want to tell everyone about. I’ve had a few. So OK, let’s get them all out there.

Peter Cook and Sir Alec Guinness

I lived in London in 1973, working in the library at the Natural History Museum in South Kensington (see short story here at p 24). One day I went to browse in a record bar in Mayfair. Behind the counter was an ex-Bathurst boy, Peter Dixon (I’d grown up there). As we chatted, he was full of stories about who came into the shop and their musical tastes. One who did so often, was Barry Humphries.

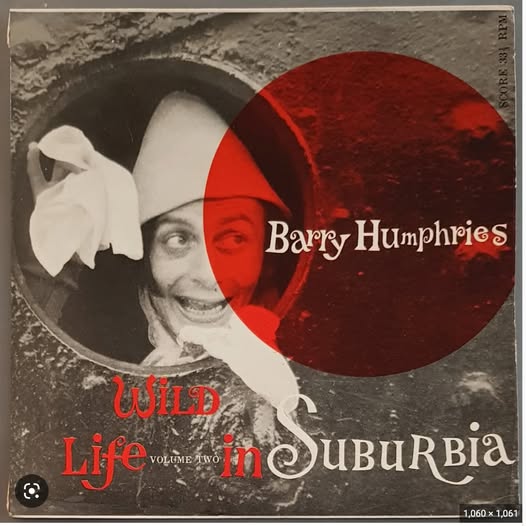

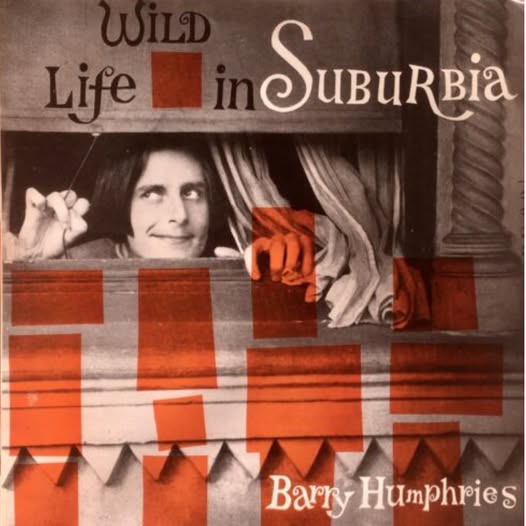

Humphries had been on the wagon for many months with his alcoholism and was soon to perform in an invitation-only comeback show in the small, intimate theatre of the May Fair Hotel. Peter had been given a ticket. I had long had a passion for Humphries’ Sandy Stone character and still own both of the very rare 7 inch 33rpm Wildlife in Suburbia records from 1958-59, that I bought as a boy (pictured below). I can recite lengthy monologues of two of them (Days of the week, Sandy’s Christmas). [both for sale if you’re interested]

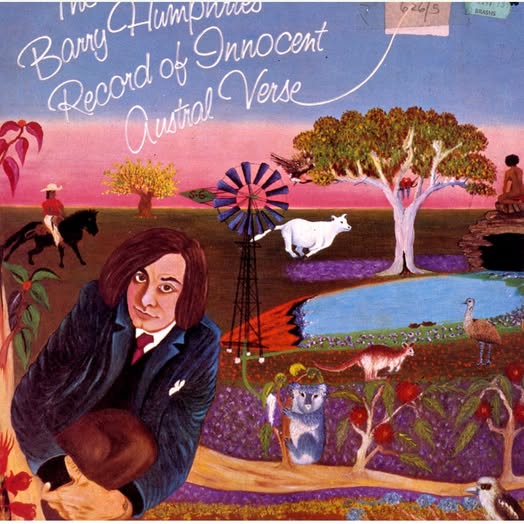

I told Peter all this and he said he’d ask Barry if I could have a couple of tickets (one for my first wife, Annie). I went in next week and was handed the tickets and an autographed copy of his recent LP The Barry Humphries Record of Innocent Austral Verse.

On the big night, we shuffled into our numbered seats. I was right next to Sir Alec Guinness (1914-2000) and Peter Cook (1937-1995) (of Peter Cook and Dudley Moore) was in the seat in front of me. I had to squeeze past Dianna Rigg (1938-2020), star of The Avengers.

What a night.

Mel Gibson

In the 1970s and 80s, I was a regular at the Roma café in Sydney’s Haymarket, just down from the Capitol Theatre. I worked for a time in the McKell Building just behind the Capitol. I’d always have a cappuccino and one of their legendary almond twists. Mad Max had been released in April 1979, starring Mel Gibson. It was huge for him. So one morning I was alone at a table in the Roma, and there he was, on his own, standing and asking me would it be OK if he shared my table. No problem, Mel. No small talk. Just a quiet coffee.

The Rev Fred Nile

I was flying from Amsterdam to Sydney, and in business class in the upper deck of a 747 where you are next to another passenger. It was before the days of the pull up screen that shielded you from the person in the next seat. I had boarded earlier than whoever it was who would be sitting next to me. Then along he came. It was Fred Nile, Australia’s dour morals crusader. The Sodom and Gomorrah cataloguer, stepping out of the Amsterdam cesspool. Oh Jesus. I nodded at him as he took his seat but that was our only interaction on that very long, silent flight.

John Brass, dual-code rugby international

On a flight from Sydney to London, I had the third seat in an economy row with John Brass and his wife. Brass was an Australian dual rugby and rugby league international, playing 12 matches for Australia in rugby (1966-68) and 6 in league (1970, 1975). League match commentator Frank Hyde used to say he had the best pair of hands in rugby league. I’d been a huge Eastern Suburbs Roosters fan in the 1970s and so had lots to talk about. We got through quite a few beers and he loosened up about all his old team mates. The nicest of guys.

Tina Turner

Many years ago, I’d seen Tina Turner perform at St George Leagues Club in Sydney’s suburbs. I went along with some Aboriginal health students who were down from the bush. She was without doubt the most high energy performer I ever saw. The students were hugely excited. I think it must have been around the same time, I was on a flight to Melbourne. She was on board, it was her birthday and she came down the aisle with a trolley with a giant birthday cake, serving every passenger a slice. People loved it!

Luc Longley

On July 20, 1995 I found myself at a table at a black tie dinner at Sydney’s Darling Harbour for the 2000 Sydney Olympics. I’d received an invitation to attend and had no idea why. I’m far from loaded and while we have always donated to various charities over the years, forking out for the Olympics couldn’t have been a lower priority. This was what imagined was the purpose. But no.

I was seated in a pre-arranged seat around a circular table along with about 10 others. Opposite me was a towering figure who was vaguely familiar. I sheepishly asked the man on my right who he was. He didn’t know either, but it was Luc Longley (2.18m) who played for the Chicago Bulls basketball team. So who was my other ignorant informer? Only Allan Moss, the CEO of Macquarie Bank. When he retired in 2008, he walked away with an estimated $100m package.

Oh boy. What could I talk about to him over the next couple of hours? It was well before the time when your bank sent those infernal messages to you “after your experience with his today, how likely are you to recommend us to your friends and family”, but even back then, talking about banking was still about the least interesting topic I could imagine. I knew nothing about investment banking. At the time Macquarie did not have a consumer division with actual customers to allow my to ask all the questions I didn’t have.

I knew his wife was Irene Moss, former head of the NSW Anti Discrimination Board, but figured he would feel my asking about his wife’s important job rather than his was sub-par. I don’t recall him asking me anything about my work or life. So it was a long night. We both had little conversation for each other.

I found out later that the dinner was all about bringing the top end of town on board the Olympics, with hopes of corporate splashes. Each table was assigned two “interesting” people to embellish the event: Longley and me, apparently. I was a fizzer. Moss might have got his $100m but, hey, I still have the souvenir wine glass.

Slim Dusty

In the 1970s, worked with a woman for while whose boyfriend played violin in Slim Dusty’s band. She called me one Saturday morning and said Slim was playing Cronulla League’s Club that night and they were short of a road crew dog’s body. Did I want a night’s work? I jumped at it and went down in the afternoon to help unload the sound gear from a truck. They then asked if I would stay around till the end of the gig that evening and act as door marshal to the band’s backstage room, and then help pack up.

The brief was that after every gig there would be small queue of people who would want to meet up with Slim. My job was to explain nicely that he was very tired after a long day and, sorry, he couldn’t see fans. I hope they understood etc.

About 15 or so came toward the backstage entrance and most were OK with being turned away. But there were a few who were ready with stories to see them past my imposing presence. One pulled out a photo of a small child and said to show it to Slim because he’d been to her christening as a baby in some Queensland backblocks town years ago. “He’ll remember me, for sure”. He stood his ground, so I went in and summarised the situation to Slim. “Oh well, I guess I’d better be Slim Dusty for a while” he said putting in his hat and stepping outside to greet the beaming bloke.

Pat Cummins

In November 2023, I was with my wife and very young grandson at Clovelly beach about 9am. Its sheltered bay is perfect for toddlers to paddle in the water. There were four or so mothers with similarly young kids and a bunch of schoolboys doing some sort of drills on the sand in in the water with a teacher.

Suddenly Trish said “wow, do you see who that is coming out of the water? It’s Pat Cummins!” Nah, couldn’t be I said. He’s in India at the cricket World Cup. They just beat India in the final.

But hang on. He might have just flown home. The final was the day before. He could have flown home overnight. And I’d read somewhere he lived in Clovelly. Maybe went straight to have a swim and freshen up.

But the more I looked, I thought no. He seemed tall enough, but he didn’t seem to be as tanned on the arms and face as you’d expect after weeks in the Indian sun. He was apparently with his wife and child. Trish googled the wife and yes it was her.

But no one, including us, went near them. Just another family having a morning swim. Pat came along to the outdoor shower with his child when we were there with ours. Some light chat about what a great day it was but again, il silencio about the cricket.

Is there any other country where a national sporting hero, one day after winning the World Cup, could be with his family on a beach and be left alone?

Tell me about yours